Most Boring Investment Plan Ever Continues: Buy, Hold, and Rebalance 21 Oct 10:14 PM (2 hours ago)

I rarely share any market commentary, as I mostly believe that waiting around and doing nothing is the best course of action. However, I also have about 89 browser tabs open, and writing helps me organize my thinking, so here are some thoughts.

Recent AI news seems to have kicked off both even more AI optimism and AI skepticism. Here’s a Bloomberg article (paywall) outlining some of the circular deals:

Matt Levine has the funniest parody of this situation with tech CEOs whispering “omniscient robots” to each other and then saying “yesssssss”. From here on out, this is what I’ll visualize when a new deal is announced.

The financing tool is, you go to Broadcom and you put your arm around their shoulder and you gesture sweepingly in the distance and whisper “omniscient robots” and they whisper “yesssss” and you say “we’ll need a few hundred billions dollars of chips and equipment from you” and they say “of course” and you say “good” and they say “do you have hundreds of billions of dollars” and you whisper “omniscient robots” again and they are enlightened. And then you announce the deal and Broadcom’s stock adds $150 billion of market capitalization and you’re like “see” and they’re like “yes” and you’re like “omniscient robots” and they’re like “I know right.” That is the financing tool!

I mean, if OpenAI wants to buy $500 billion of NVDA chips, but doesn’t actually have $500 billion, but instead signs a promise that it will buy $500 billion of chips, and then NVDA goes up by $500 billion in market cap in response, and now agrees to either invest or lend $500B to OpenAI… is that pioneering genius? Or is it a bubble?

Of course, I have no idea. Heck, all the things that happened yesterday are a huge shock to me. How could I possibly predict the future?

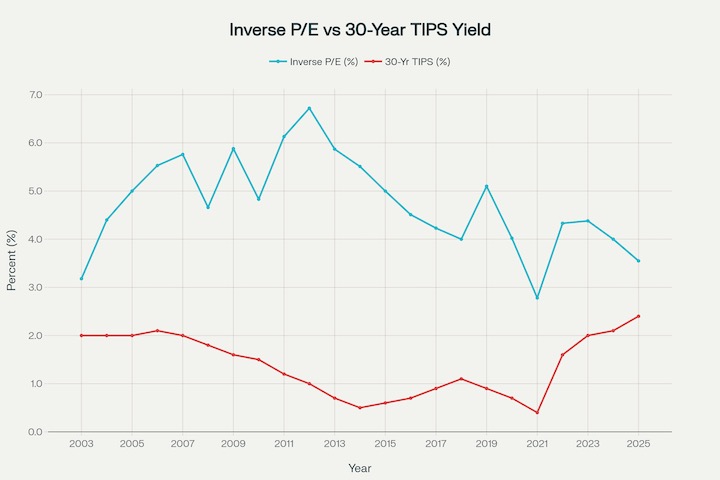

I do know that if I sold every time I saw a chart warning me about high P/E ratios, I’d have been in cash for more than a decade and my portfolio would be much, much smaller. Instead, let’s look at some updated relative valuations to better measure the “crazy”. One thing is the earnings yield, which is the inverse of the price/earning ratio. So if the earning yield is 5%, then if the price is $100 then it reports $5 a year in earnings. If you own the S&P 500, it might be reasonable to assume that over the long-term, your earnings will grow at least with inflation.

Here are the historical earnings of the S&P 500 on a log scale, showing how they in fact tend to increase faster than inflation over the long run. (Source: Yardeni)

Then we also have TIPS, which offer a guaranteed real yield above inflation. Instead of traditional Treasury bonds, you could use this TIPS real yield as a base “risk-free rate”.

Here is a chart that compares the historical S&P 500 earnings yield and the TIPS real yield. Sources: FRED and Multpl. As you can see, the gap between the two is still positive, but it’s definitely shrinking and close to the narrowest it’s been during the last 15 years (right now about 1%).

The problem is that trying to time this stuff is not a good idea. It’s one of the those enduring lessons about investing. I can’t predict the top. I can’t predict the bottom.

One key feature of bubbles is seeing someone else get rich doing something stupid/risky, not being able to handle it, and then deciding you have to play along too. There is definitely a lot of the “getting rich doing something risky” going on. But then again, there are also a lot of people who went to zero but are quiet about it. All the money that went into the GraniteShares 3x Short AMD ETP… already went to zero.

At the same time, another one of the most important lessons of building wealth is that you must always avoid “blowing up”. If you multiply by zero, it doesn’t matter what your historical returns are. Never stop the compounding. Consider the scenario of (1) the stocks in your portfolio going down by 50%, (2) losing your job for 6 months, and (3) other people panicking. Those three things tend to happen at the same time.

As Howard Marks said in 2001 in one of the memos that made him famous: “You Can’t Predict. You Can Prepare.” Source: Humble Dollar. Now is a good time to check if you are prepared by checking the risk levels of your portfolio, your cash reserves, your job stability, and all of the other psychological intangibles.

I like to think that I am prepared. Portfolio-wise, I continue to buy, hold, and rebalance. Buying with ongoing IRA/401k contributions. Holding and not selling anything. Rebalancing by investing all incoming funds and dividends into Treasury bonds because I am overweight in US and international stocks. I’m keeping an eye on the cash cushion and planning for large expenses – we did some home repairs recently and probably have more on the horizon. I don’t require much liquidity in the near future, and I don’t own any private assets with potential liquidity concerns.

Barclays Bank Tiered Savings: $200 Bonus on $30,000 Deposit (+3.90% APY) 19 Oct 10:09 AM (2 days ago)

Barclays Bank Delaware is an FDIC-insured US bank with a limited-time offer of a $200 bonus if you deposit $30,000+ in new funds into their Tiered Savings Account. You must fund within 30 days of opening, and maintain the balance of at least $30,000 for another 120 consecutive days after funding. Bonus arrives after another 60 days. You must be a new Barclays Tiered Savings customer (current and previous Barclays customers with a Savings or CD are not eligible). Note that they have other flavors of savings accounts, so be sure to apply for the right one. Direct deposit is not required. Offer expires 12/31/2025.

There is a slightly better version of this bonus for AARP members (you will need an active membership number).

Here are the current interest rate tiers, as of 10/19/25. Note that it’s basically a 3.90% APY account unless you have a $250,000 balance. As with all savings accounts, the rates are also subject to change at any time.

Bonus math. This is a 0.66% bonus on $25,000 if you keep it there for 120 days, which makes it the equivalent of 2% APY annualized. Bonus will be paid around Day 180 and the account must be open at that time, but you only need to maintain full balance through Day 120 after funding. The bonus is on top of the standard interest rate, currently a relatively competitive 3.90% APY for a $25,000 balance as of 10/19/25.

The equivalent of roughly 5.90% total APY over 120 days makes it a decent offer for those with compatible balances looking for short-term place to hold their cash for a few months. However, it’s not as good as the currently live CIT Bank deposit offer that offers $225 for $25k and $300 for $50k with no minimum holding period.

Lennar / Millrose Properties Odd Lot Tender Opportunity (Guest Post; ~$750 Potential Value) 16 Oct 11:05 PM (5 days ago)

From time to time, I participate in certain stock exchange offers which include a special provision for smaller investors, called “odd lot tenders”. You can find more background information on these short-term “arbitrage” plays in the last two offers that I joined: Cummins/Atmus Filtration and Johnson & Johnson/Kenvue.

Recently, Lennar (primarily a homebuilder) announced such an exchange offer as they try to complete their spinoff of Millrose Properties (an REIT, primarily a land bank). This time, Rich Howe of StockSpinoffInvesting.com – who has a lot more experience with these deals than me – has generously agreed to share his summary and analysis of the deal. Please enjoy the following guest post:

—

Buy Lennar – Exchange Offer – Special Situation

October 15, 2025

LEN: $122.21

Market Cap: $30BN

Recommendation: Buy 99 shares of LEN, Exchange for shares of MRP

Expected Profit: $772 / 6.4%

Summary

Lennar (LEN) announced an exchange offer on October 10, 2025 whereby investors can exchange their LEN shares for shares of Millrose Properties (MRP), Lennar’s land bank spin-off. To incentivize the exchange, LEN investors will receive $106.43 of value in MRP shares for every $100 of value in LEN shares. I expect the exchange offer to be oversubscribed. However, there is an odd lot provision such that any LEN shareholders with 99 shares or less (odd lot provision) will not be prorated. Thus, there is an opportunity to buy 99 shares of LEN and exchange them for shares of MRP. This should result in a profit of ~6.4% / ~$757 (at current prices) in less than a month. The profit is not guaranteed (of course!) but is low risk, in my opinion. To participate in this exchange offer, you must contact your broker (you may be able to participate in the exchange offer online). It will not happen automatically.

Deadline: The exchange offer will expire on November 7, 2025. So this is time sensitive. Brokers typically require investors to give them notice about the exchange well before the official deadline. Schwab’s deadline will likely be November 5, 2025, but it would be prudent to buy on November 3, 2025 at the latest as it takes two days for shares to settle. I’m planning to buy 99 shares of LEN shares on or before November 3rd and then immediately call Schwab and ask to participate in the exchange offer. Other brokers (Fidelity, Interactive Brokers, etc.) have their own internal deadlines which are typically after the Schwab deadline.

Additional Details

Lennar (LEN) spun-off ~80% of Millrose Properties (MRP), its land bank, in February 2025.

It retained ~20% of the business.

On October 10, 2025, Lennar formally announced that it would spin off its remaining ~20% stake in Millrose Properties via an exchange offer.

I’ve highlighted key terms but you can visit the transaction’s live website with additional details.

For every $100 shares of LEN that you own, you will receive $106.38 of MRP shares.

Since this exchange represents an attractive return in a short period of time, I expect the offering to be oversubscribed (similar to previous exchange offers that I’ve covered).

However, there is an odd lot provision such that if you own fewer than 100 shares, you will not prorated.

Here is the exchange offer filing and a website which tracks the exchange offer indicative exchange ratio.

This offering is very similar to the many other split off/exchange offers that we’ve participated in.

Examples:

- CMI/ATMU Exchange – Unhedged trade worked well.

- JNJ/KVUE Exchange – Unhedged trade worked well (Iag shouldn’t have held onto KVUE shares).

- LLY/ELAN Exchange – Unhedged trade worked well.

- DHR/NVST Exchange – Unhedged trade worked well.

- ECL/CHX Exchange – Unhedged trade worked well.

- DD/IFF Exchange – Unhedged trade worked well.

- MMM/NEOG Exchange – Unhedged trade did not work.

How to Execute the Trade

LEN is currently trading at $122.21 per share.

MRP is currently trading at $31.96.

Here’s how the math works at current price levels.

Step 1

Buy 99 shares of LEN for $122.21 per share. Total cost of $12,099.

Step 2

Per the exchange offer, shareholders who elect to exchange their LEN shares will receive MRP shares at a 6% discount or at a price of $30.04 ($31.96 x (1-6%)). The MRP price hasn’t been finalized yet. But I’m using the current price plus the discount as I think that’s the best way to approximate what the actual price will be. The actual price will be determined by a formula laid out here.

$12,099 / $30.04 = 402.72 shares of MRP

402.72 shares of LEN / 99 shares of MRP = 4.07. 4.07 is lower than the max exchange ratio of 4.1367. If the ratio were higher than 4.1367, the number of MRP shares would be maxed out at 409 (4.1367 * 99).

Step 3

Sell MRP shares that are received once the exchange goes through. It usually takes Schwab about a week to process the exchange offer. I expect to receive my MRP shares by November 14, 2025 or shortly thereafter.

At current prices, the trade is expected to generate a profit of $772.

In terms of timing, the exchange offer expires on November 7, 2025 (unless LEN changes it), and so I recommend that you buy LEN shares no later than November 3rd to ensure you make the deadline (it takes two trading days for your purchase to settle and brokers internal deadlines are usually 2 days prior to the official company deadline). After you purchase shares, call your broker and ask them to tender your shares. This is important. Your participation in the exchange isn’t automatic.

I created a spreadsheet to track the profitability of this trade. Here is a screenshot of it:

You can access the spreadsheet here: LEN / MRP Exchange Offer Spreadsheet

(to edit, make a copy of the spreadsheet and plug in your own assumptions)

Thoughts on Millrose Properties?

Millrose was created when Lennar contributed ~$5.5 billion in undeveloped, partially developed, and some fully developed land assets, along with up to $1 billion in cash, to Millrose. Millrose operates as an independent entity, acquiring and developing land to deliver finished homesites under land option contracts. At the time of the spin-off, it only served Lennar but it plans to engage with other homebuilders as well.

Lennar pays Millrose option fees for the right to buy land on Millrose’s balance sheet.

This strategic move is part of Lennar’s ongoing shift toward an asset-light operating model, aiming to reduce financial risk and enhance returns by minimizing direct land ownership.

I’m happy to own Millrose Properties at a 6% discount, but don’t want to own the stock for the long term as I believe its ability to grow and generate upside is limited given Lennar’s right to purchase its land.

What are the risks?

LEN Sells Off

If you buy LEN, and it sells off prior to the exchange, you could lose money. I’m not particularly worried about this risk, as investors will likely continue to bid LEN shares up to take advantage of the share exchange.

A major sell off could happen if some random negative news hits LEN (for instance negative news in a lawsuit). This is unlikely but did happen during the MMM/NEOG exchange offer. JNJ also had a negative court ruling during its exchange offer, but the exchange was still profitable.

If LEN does sell off, it would have to sell off by ~6.4% for you to lose money. To minimize risk, you could also short out the MRP exposure.

I looked back at the performance of the parent during similar transactions and found that it usually performs well (average: +2.2%; median: +3.8%)

The Exchange Is Canceled or the Odd Lot Provision is Removed

Lennar wants to distribute its ~20% stake in Millrose Properties and this is an efficient way to do so. I don’t expect it to be canceled, but it’s possible.

The odd lot provision could be removed, however, this has never happened for split off transactions (that I’m aware of). Nonetheless, it could happen!

Millrose Properties (MRP) Stock is Weak After the Share Exchange Closes

If the share exchange closes and investors who’ve exchanged their LEN shares for MRP shares make 6.4%, but then MRP shares immediately depreciate by more than 6.4%, this trade will lose money. In other words, this trade can lose money even though the initial math looks favorable.

While this risk is valid, I’m comfortable participating in this trade and believe it represents an attractive risk/reward.

Disclosure

Rich Howe, owner of Stock Spin-off Investing (“SSOI”), doesn’t own LEN shares but plans to buy them. All expressions of opinion are subject to change without notice. This article is provided for informational purposes. We do not warrant the completeness or accuracy of this content. Please do your own due diligence and consult with an investment adviser before buying or selling any stock mentioned on www.stockspinoffinvesting.com.

How to Close Your US Bank Account or US Bank Credit Card Online 15 Oct 4:37 PM (6 days ago)

After US Bank completely changed the terms of their Smartly Rewards credit card less than 6 months after application, I have nearly completed closing nearly all of my US Bank accounts, including bank accounts, credit cards, and brokerage accounts. The process was relatively simple, and you don’t need to visit a branch or call them on the phone if you don’t want to. You can close your account online using the Live Chat feature on their website. Simply type in “close account” into their Smart Assistant search bar, and then they will ask which account you want to close. After you select it, you will be presented with the following popup options. These may be different based on their daytime/weekday business hours, but I was able to reach someone in less than a minute. The Live Chat agent closed things efficiently while I did other stuff on my computer.

If you have a US Bank credit card with an annual fee that was charged to your account within the last 30 days, the annual fee will be automatically refunded after you close the credit card account. In other words, you can wait until you actually see the new annual fee charged to the account before you close the account (if you want). That may give you more time to redeem all your rewards (which will be lost upon closure) and use up all the perks like a travel statement credit or TSA PreCheck/Global Entry application fee. In the past, US Bank has also offered “retention” offers in order to keep your business, but I was not offered anything this time when canceling. Perhaps if you call into a human, they might be more likely to offer something, I don’t know.

For the US Bank brokerage account, I had moved in over $100k in assets to qualify for their highest loyalty tier. Well, that loyalty was not rewarded, so I was off again looking for the best place for my assets. I thought about the Kraken up to 2% offer for 1-year hold, but the reward-to-risk ratio just wasn’t there for me. The current regulatory environment is not pro-consumer, and I didn’t feel comfortable with possible having to beg and plead for my $100k back if Kraken blew themselves up in a crypto meltdown. I also didn’t like how the “up to” 2% bonus was contingent on outside factors. I’ll still take the easy crypto money, though!

In the end, I chose this Merrill Edge transfer offer, which is a $400 bonus on $100k transferred (0.4%) with a much shorter 90-day hold. I already have an account with Merrill and Preferred Rewards status, and I find them reliable and professional. Merrill Edge will also reimburse me for the $95 outgoing transfer fee charged by US Bank. Thankfully, this offer is also valid for existing customers. If one bank isn’t meeting your needs, there is most likely a better offer out there.

inKind Dining App: New $15 off $15 Promo 15 Oct 11:38 AM (6 days ago)

Added new $15 off $15 link. inKind is a startup that provides restaurants financing in exchange for “food and beverage credit”. Retail customers can use inKind to pay their food bill at participating restaurants through the app and get 20% back in “inKind Cash” credit on their bills. They say over 4,000 restaurants are in their network, mostly nicer local spots, but some chains like California Pizza Kitchen are also included (which is a favorite for our family).

The good thing is that you don’t have to let the server know ahead of time, or do anything awkward like using a coupon. You just get the check and then use the inKind app to pay. All the restaurants use the same backend Toast software, so you just need a number from the top of the paper bill. Within the inKind app, you can link your existing rewards credit card and also earn those rewards on your net cost (will still code as dining). inKind works primarily for dine-in, but some restaurants do specifically allow take-out. You are supposed to order the takeout from within the inKind app, but as long as you get the bill with the code, you should be able to pay using the app.

Current promos:

- New customers should first open via a $25 off $50+ referral link (that’s mine, thanks if you use it!). Expires 30 days after claiming. “Friend of Jonathan”.

- Existing customers can visit this separate $15 off $15+ link for another order. May be targeted. Added October 2025 and marked as “Thanks for your feedback”.

- Existing customers can visit this separate $25 off $50+ link for another order. May be targeted. Added October 2025 and marked as “Thanks for your feedback”.

Existing customers can visit this separate $25 off $25+ link for another order. Maybe be targeted. Expires 9/30/25. Added September 2025 and marked as “25 on Us”.Expired.- Existing customers can visit this separate $25 off $75+ link for another order. Expires 10/28/25. Added September 2025 and marked as “Anniversary Gift”.

If you have a big bill, know that you can “split the check” within the app, so that two separate people can use a $25 off $50 discount in their respective inKind apps.

You should see your multiple offers in the app:

California Pizza Kitchen is part of the inKind network, and they are a reliable way to use these offers. They usually have some sort of promo going, like right now they have $10 Pizzas on Monday and Tuesday that you can stack.

Now, I can’t guarantee this will work for you, but this may work with CPK take-out and not just dine-in. (Be sure order directly from CPK.com or over the phone, not another app like Doordash or Grubhub.) The place we go to just has a separate take-out counter and the default check that comes from them should work with inKind. If not, tell them you want to pay with inKind and they should be able to generate the right check with the number on top. Make sure you meet the minimum purchase amount.

Best Interest Rates Survey: Bank Accounts, Treasury Bills, Money Markets, ETFs – October 2025 13 Oct 7:48 PM (8 days ago)

Here’s my monthly survey of the best interest rates on cash as of October 2025, roughly sorted from shortest to longest maturities. Banks and brokerages love taking advantage of our idle cash, and you can often earning more money while keeping the same level of safety by moving to another FDIC-insured bank or NCUA-insured credit union. Check out my Ultimate Rate-Chaser Calculator to see how much extra interest you could earn from switching. Rates listed are available to everyone nationwide. Rates checked as of 10/13/2025.

TL;DR: Savings account interest rates have dropped slightly overall. You can get 4.6% and 4.5% APY if you accept some hoops/restrictions. Short-term T-Bill rates have fallen slightly, now ~4.1%. Top 5-year CD rates are ~4.3% APY, while 5-year Treasury rate is ~3.6%.

High-yield savings accounts*

Since the huge megabanks still pay essentially no interest, everyone should at least have a separate, no-fee online savings account to piggy-back onto your existing checking account. The interest rates on savings accounts can drop at any time, so I list the top rates as well as competitive rates from banks with a history of competitive rates and solid user experience. Some banks will bait you with a temporary top rate and then lower the rates in the hopes that you are too lazy to leave.

- The top saving rate at the moment: Pibank at 4.60% APY (no min), but they have some weird restrictions; like you can only use wire/Plaid to deposit and wire transfers to withdraw funds?! Presidential Bank has a 4.50% APY savings account that requires an Advantage Checking account. You’ll have to decide if the hoops are worth it. CIT Platinum Savings is now at 3.85% APY with $5,000+ balance and is offering an up to $300 deposit bonus which increases your effective APY for a while. There are many banks in between.

- SoFi Bank is at 3.80% APY + up to 4.50% APY for 6 months + $325 new account bonus with qualifying direct deposit. You must maintain a direct deposit of any amount (even $1) each month for the higher APY. SoFi has historically competitive rates and full banking features.

- Here is a limited survey of high-yield savings accounts. They aren’t the top rates, but a group that have historically kept it relatively competitive such that I like to track their history. I call this the “okay/good” zone of 3.40%+.

Short-term guaranteed rates (1 year and under)

A common question is what to do with a big pile of cash that you’re waiting to deploy shortly (plan to buy a house soon, just sold your house, just sold your business, legal settlement, inheritance). My usual advice is to keep things simple and take your time. If not a savings account, then put it in a flexible short-term CD under the FDIC limits until you have a plan.

- No Penalty CDs offer a fixed interest rate that can never go down, but you can still take out your money (once) without any fees if you want to use it elsewhere. Marcus has a 13-month No Penalty CD at 3.95% APY ($500 minimum deposit). Farmer’s Insurance FCU has a 9-month No Penalty CD at 4.00% APY ($1,000 minimum deposit). USA USALLIANCE Financial CU has a 11-month No Penalty CD at 3.90% APY ($500 minimum deposit).

- Abound Credit Union has a 10-month certificate at 4.30% APY ($500 min). Early withdrawal penalty is 90 days of interest. Anyone can join this credit union via $10 membership fee to join partner organization.

Money market mutual funds

Many brokerage firms that pay out very little interest on their default cash sweep funds (and keep the difference for themselves). Note: Money market mutual funds are highly-regulated, but ultimately not FDIC-insured, so I would still stick with highly reputable firms.

- Vanguard Federal Money Market Fund (VMFXX) is the default sweep option for Vanguard brokerage accounts, which has a 7-day SEC yield of 4.04% (changes daily, but also works out to a compound yield of 4.12%, which is better for comparing against APY). Odds are this is much higher than your own broker’s default cash sweep interest rate.

- Vanguard Treasury Money Market Fund (VUSXX) is an alternative money market fund which you must manually purchase, but the interest will be mostly (100% for 2024 tax year) exempt from state and local income taxes because it comes from qualifying US government obligations. Current 7-day SEC yield of 4.04% (compound yield of 4.12%).

Treasury Bills and Ultra-short Treasury ETFs

Another option is to buy individual Treasury bills which come in a variety of maturities from 4-weeks to 52-weeks and are fully backed by the US government. You can also invest in ETFs that hold a rotating basket of short-term Treasury Bills for you, while charging a small management fee for doing so. T-bill interest is exempt from state and local income taxes, which can make a significant difference in your effective yield.

- You can build your own T-Bill ladder at TreasuryDirect.gov or via a brokerage account with a bond desk like Vanguard and Fidelity. Here are the current Treasury Bill rates. As of 10/10/25, a new 4-week T-Bill had the equivalent of 4.09% annualized interest and a 52-week T-Bill had the equivalent of 3.61% annualized interest.

- The iShares 0-3 Month Treasury Bond ETF (SGOV) has a 4.12% 30-day SEC yield (0.09% expense ratio) and effective duration of 0.10 years. SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) has a 4.02% 30-day SEC yield (0.136% expense ratio) and effective duration of 0.15 years. The new Vanguard 0-3 Month Treasury Bill ETF (VBIL) has a 4.12% 30-day SEC yield (0.07% expense ratio) and effective duration of 0.10 years.

US Savings Bonds

Series I Savings Bonds offer rates that are linked to inflation and backed by the US government. You must hold them for at least a year. If you redeem them within 5 years there is a penalty of the last 3 months of interest. The annual purchase limit for electronic I bonds is $10,000 per Social Security Number, available online at TreasuryDirect.gov.

- “I Bonds” bought between May 2025 and October 2025 will earn a 3.98% rate for the first six months. The rate of the subsequent 6-month period will be based on inflation again. More on Savings Bonds here.

- In mid-October 2025, the CPI will be announced and you will have a short period where you will have a very close estimate of the rate for the next 12 months. I will post another update at that time.

Rewards checking accounts

These unique checking accounts pay above-average interest rates, but with unique risks. You have to jump through certain hoops which usually involve 10+ debit card purchases each cycle, a certain number of ACH/direct deposits, and/or a certain number of logins per month. If you make a mistake (or they judge that you did) you risk earning zero interest for that month. Some folks don’t mind the extra work and attention required, while others would rather not bother. Rates can also drop suddenly, leaving a “bait-and-switch” feeling.

- OnPath Federal Credit Union (my review) pays 7.00% APY on up to $10,000 if you make 15 debit card purchases, opt into online statements, and login to online or mobile banking once per statement cycle. Anyone can join this credit union via $5 membership fee to join partner organization. You can also get a $150 Visa Reward card when you open a new account and make qualifying transactions.

- Genisys Credit Union pays 6.75% APY on up to $7,500 if you make 10 debit card purchases of $5+ each per statement cycle, and opt into online statements. Anyone can join this credit union via $5 membership fee to join partner organization.

- Oklahoma Central Credit Union pays 6.00% APY on up to $10,000 if you make 15 debit card purchases (non-ATM) per statement cycle. Anyone can join this credit union if they are “affiliated with another credit union”.

- La Capitol Federal Credit Union pays 5.75% APY on up to $10,000 if you make 15 debit card purchases of at least $5 each per statement cycle. Anyone can join this credit union via partner organization, Louisiana Association for Personal Financial Achievement ($20).

- First Southern Bank pays 5.50% APY on up to $25,000 if you make at least 15 debit card purchases, 1 ACH credit or payment transaction, and enroll in online statements.

- Credit Union of New Jersey pays 6.00% APY on up to $25,000 if you make 12 debit card purchases, opt into online statements, and make at least 1 direct deposit, online bill payment, or automatic payment (ACH) per statement cycle. Anyone can join this credit union via $5 membership fee to join partner organization.

- Andrews Federal Credit Union pays 5.50% APY (down from 6%) on up to $25,000 if you make 15 debit card purchases, opt into online statements, and make at least 1 direct deposit or ACH transaction per statement cycle. Anyone can join this credit union via partner organization.

- Find a locally-restricted rewards checking account at DepositAccounts.

Certificates of deposit (greater than 1 year)

CDs offer higher rates, but come with an early withdrawal penalty. By finding a bank CD with a reasonable early withdrawal penalty, you can enjoy higher rates but maintain access in a true emergency. Alternatively, consider building a CD ladder of different maturity lengths (ex. 1/2/3/4/5-years) such that you have access to part of the ladder each year, but your blended interest rate is higher than a savings account. When one CD matures, use that money to buy another 5-year CD to keep the ladder going. Some CDs also offer “add-ons” where you can deposit more funds if rates drop.

- United Fidelity Bank has a 5-year certificate at 4.30% APY ($1,000 minimum), 4-year at 4.25% APY, 3-year at 4.20% APY, 2-year at 4.20% APY, and 1.5-year at 4.25% APY. Early withdrawal penalties are not disclosed clearly online.

- Mountain America Credit Union (MACU) has a 5-year certificate at 4.00% APY ($500 minimum), 4-year at 4.00% APY, 3-year at 4.00% APY, 2-year at 4.25% APY, and 1-year at 4.00% APY. Early withdrawal penalty for the 4-year and 5-year is 365 days of interest. Anyone can join this credit union via partner organization American Consumer Council for a one-time $5 fee (or try promo code “consumer”).

- Lafayette Federal Credit Union (LFCU) has a 5-year certificate at 3.97% APY ($500 minimum), 4-year at 3.97% APY, 3-year at 3.97% APY, 2-year at 4.02% APY, and 1-year at 4.02% APY. Slightly higher rates with jumbo $100,000+ balances. Note that the early withdrawal penalty for the 5-year is a relatively large 600 days of interest. Anyone nationwide can join LFCU by joining the Home Ownership Financial Literacy Council (HOFLC) for a one-time $10 fee.

- You can buy certificates of deposit via the bond desks of Vanguard and Fidelity. You may need an account to see the rates. These “brokered CDs” offer FDIC insurance and easy laddering, but they don’t come with predictable early withdrawal penalties. Right now, I see a 5-year non-callable brokered CD at 3.75% APY (callable: no, call protection: yes). Be warned that both Vanguard and Fidelity will list higher rates from callable CDs, which importantly means they can (and will!) call back your CD if rates drop significantly later.

Longer-term Instruments

I’d use these with caution due to increased interest rate risk (tbh, I don’t use them at all), but I still track them to see the rest of the current yield curve.

- Willing to lock up your money for 10 years? You can buy long-term certificates of deposit via the bond desks of Vanguard and Fidelity. These “brokered CDs” offer FDIC insurance, but they don’t come with predictable early withdrawal penalties. You might find something that pays more than your other brokerage cash and Treasury options. Right now, I see a 10-year CDs at [n/a] (non-callable) vs. 4.05% for a 10-year Treasury. Watch out for higher rates from callable CDs where they can call your CD back if interest rates drop.

All rates were checked as of 10/13/25.

* I no longer recommend fintech companies due to the possibility of significant loss due to poor recordkeeping and the lack of government protection in such scenarios. The point of cash is absolute safety of principal.

Photo by Giorgio Trovato on Unsplash

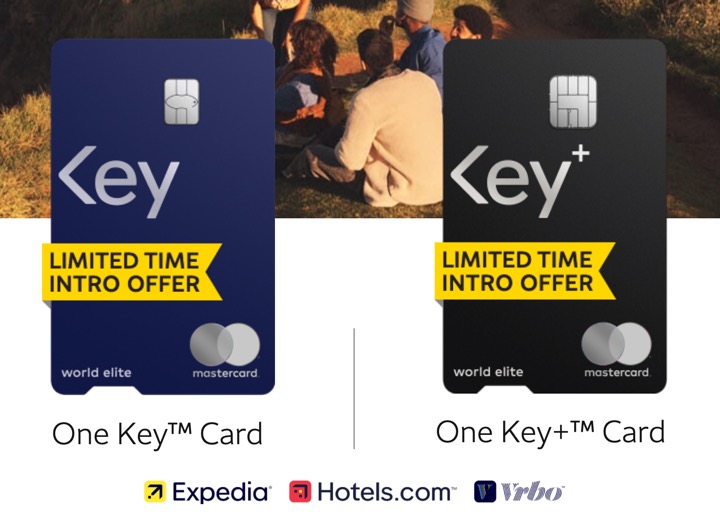

One Key Credit Cards (VRBO, Expedia, Hotels.com): $400/$600 OneKeyCash Bonus (Limited-Time Offer) 9 Oct 11:51 PM (12 days ago)

The One Key and One Key+ credit cards are travel rewards cards offered by Expedia Group (Expedia, Hotels.com, and VRBO) and issued by Wells Fargo. Rewards are earned as “OneKeyCash” which can only be used to offset travel bookings on one of those three sites. Personally, the main draw for me is VRBO as we often book one larger space instead of two hotel rooms for our family of five. Right now, there is a limited-time offer. Highlights:

One Key Card

- New cardholder bonus: $400 in OneKeyCash after you spend $1,000 on purchases in the first 3 months.

- 3% back in OneKeyCash on Expedia, Hotels.com and Vrbo.

- 3% back in OneKeyCash at gas stations, grocery stores and on dining.

- 1.5% back in OneKeyCash on all other purchases.

- Automatic Silver One Key status. Supposedly, this includes “savings of 15% or more on over 10,000 hotels worldwide.” Unlock Gold when you spend $15,000 per calendar year.

- Other benefits include no foreign transaction fees, cell phone protection, and travel protections like travel accident insurance and trip cancellation insurance.

- No annual fee.

One Key+ Card (note the plus sign!)

- New cardholder bonus: $600 in OneKeyCash after you spend $3,000 on purchases in the first 3 months.

- 3% back in OneKeyCash on Expedia, Hotels.com and Vrbo.

- 3% back in OneKeyCash at gas stations, grocery stores and on dining.

- 2% back in OneKeyCash on all other purchases.

- Automatic Gold One Key status. Supposedly, this includes “savings of 20% or more on over 10,000 hotels worldwide.” Unlock Platinum when you spend $30,000 per calendar year.

- $100 in OneKeyCash each year on your Cardholder anniversary.

- $120 Global Entry/TSA credit. Receive one statement credit up to $120 for a Trusted Traveler Program, such as Global Entry® or TSA PreCheck®.

- Other benefits include no foreign transaction fees, cell phone protection, and travel protections like travel accident insurance and trip cancellation insurance.

- $99 annual fee.

The credit card rewards stack on top of the standard OneKeyCash earned for booking on Expedia, Hotels.com, and VRBO. However, it’s often cheaper to book a hotel directly at their own website, so I usually don’t use Expedia or Hotels.com. With VRBO, often the same house is also listed on Airbnb and on a small independent management site. Sometimes VRBO is the cheapest (after all their fees and taxes) or offers the best refund policy, so I still use VRBO in those cases.

Limitations on Expedia flight bookings. You can use OneKeyCash for a flight, but note the following limitations:

To use OneKeyCash on a flight, you will need enough OneKeyCash to cover the entire cost of your eligible flight, including taxes and fees, and may not add any optional extras like checked bags or seat assignments. You can purchase those extras after booking your ticket. OneKeyCash may only be used on selected flights.

In contrast, you can use OneKeyCash to partially offset a VRBO rental, down to the penny. Note that not all VRBO properties are eligible for OneKeyCash redemption (VRBO must be their payment processor) and you must use the “Pay Now” option.

I personally don’t usually use Expedia or Hotels.com on a regular basis, but I do book on VRBO regularly enough to expect to use up the OneKeyCash bonus. For those that have done most of the other big credit card bonuses, this card still offers some good potential value, even if it is in a more restricted rewards system.

Amazon Prime Big Deals Day 2025: Check For Extended Free Trials and Easy Credits 8 Oct 1:56 PM (13 days ago)

Amazon is running yet another “Huge Sale!” called Prime Big Deal Days. I’m late, and by the time you read this, it might be over. (You probably didn’t miss that much.) Check your wishlist. Check your “Buy Again” past purchases. I’ve listed again a few of my favorite things below as well.

Yes, I’m recycling most of the stuff from an old post, but that’s the thing to do as this is when where a lot of easy credits and extended free trials are reset. Time to spend a minute to click-and-check. I’ve gotten over $50 in easy value from the free trials and refreshed Shop with Points credits.

(Note: If you are reading this in an email/RSS reader, unfortunately I am not allowed to include any Amazon affiliate links in e-mails, so they have been removed. Please click here to view the links.)

As the name suggests, most deals require a Prime membership. New members can sign up for a 30-day free trial. Amazon Prime for Young Adults (age 18-24) has a 6-month free trial and $7.49/month after that (50% off regular). If you’ve already done the trial, you can simply buy a single month of Prime for $14.99 ($6.99 with SNAP, EBT or Medicaid card).

“Shop with Points” Promos (Check again if reset/targeted) Most likely, only the top three will work this time around, but I still clicked and checked.

- Discover Cash Back.

- American Express Membership Rewards points.

- American Express Rewards Dollars (Ex. Blue Cash, Blue Cash Preferred).

- Chase Ultimate Rewards points.

- U.S. Bank Rewards points.

- Capital One Rewards points

- Citi Thank You points.

Amazon Free Trials

- Kindle Unlimited – 3 month free trial. Usually $11.99 a month. Might be a different length for you. Targeted.

- Amazon Music – 4 month free trial. Usually $10.99 a month. Targeted.

- Audible Premium Plus – 3 month free trial. Includes 1 free credit per month, so that’s 3 free audiobooks. Targeted.

- Whole Foods / Amazon Fresh Grocery Delivery Subscription – 3 month free trial. May not be a special length. Unlimited free delivery on orders $35+ from Whole Foods Market, Amazon Fresh, and local retailers. Regular price is $10 a month.

Stuff I Own (and Would Buy Again)

- Dyson V11 Origin Cordless Vacuum We still love our cordless Dyson. I’m sure a knockoff nowadays will do the trick, but this is another daily workhouse in our household. We had the V8 before, but the extra power of this one is useful.

- Amazon Eero 6E mesh WiFi router system 3-pack. If you have WiFi coverage issues and haven’t upgraded your router recently, I do recommend an upgrade. It just makes WiFi something you don’t worry about anymore. No more dead spots.

- Bose QuietComfort Bluetooth Noise Canceling Headphones. I’m not an audiophile, but these feel great, work well on planes, and are reliable.

- COSORI Air Fryer 6 Qt. Love this air fryer. We use it nearly every day; heats things up like a microwave, except it keeps things crispy instead of soggy. Easy to clean.

- Vitamix 5200 blender. Kitchen staple, sometimes we use it a lot, sometimes rarely, but it’s always there ready and powerful.

MMB Portfolio Dividend & Interest Income – October 2025 Q3 Update 7 Oct 9:49 PM (14 days ago)

Here’s my 2025 Q3 income update as a companion post to my 2025 Q3 asset allocation & performance update. Even though I don’t focus on high-dividend stocks or covered-call income strategies – I still track the income from my portfolio as an alternative metric to price performance. The total income goes up much more gradually and consistently than the number shown on brokerage statements, which helps encourage consistent investing. Here’s a related quote from Jack Bogle (source):

The true investor will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies. – Jack Bogle

Stock dividends are a portion of profits that businesses have decided to distribute directly to shareholders, as opposed to reinvesting into their business, paying back debt, or buying back shares. They have explicitly decided that they don’t need this money to improve their business, and that it would be better to distribute it to shareholders. The dividends may suffer some short-term drops, but over the long run they have grown faster than inflation.

Here is the historical growth of the S&P 500 total dividend, which tracks roughly the largest 500 stocks in the US, updated as of 2025 Q3 (via Yardeni Research):

Tracking the income from my portfolio. Three of the primary income “trees” that produce income “fruit” in my portfolio are Vanguard Total US Stock ETF (VTI), Vanguard Total International Stock ETF (VXUS), and Vanguard Real Estate Index ETF (VNQ).

In the US, the dividend culture is somewhat conservative in that shareholders expect dividends to be stable and only go up. Thus the starting yield is lower, but grows more steadily with smaller cuts during hard times. Companies do buybacks as well, often because they are easier to discontinue. Here is an updated chart of the trailing 12-month (ttm) dividend per share over the last 15 years paid by the Vanguard Total US Stock ETF (VTI) via WallStNumbers.com.

European corporate culture tends to encourage paying out a higher (sometimes even fixed) percentage of earnings as dividends, but that also means the dividends move up and down with earnings. The starting yield is currently higher but may not grow as reliably. Here is an updated chart of the trailing 12-month (ttm) dividend per share over the last 15 years paid by the Vanguard Total International Stock ETF (VXUS).

In the case of Real Estate Investment Trusts (REITs), they are legally required to distribute at least 90 percent of their taxable income to shareholders as dividends. Historically, about half of the total return from REITs is from this dividend income. Here is an updated chart of the trailing 12-month (ttm) dividend per share over the last 15 years paid by the Vanguard Real Estate Index ETF (VNQ).

The dividend yield (dividends divided by price) also serve as a rough valuation metric. When stock prices drop, this percentage metric usually goes up – which makes me feel better in a bear market. When stock prices go up, this percentage metric usually goes down, which keeps me from getting too euphoric during a bull market.

Finally, the last income component of my portfolio comes from interest from bonds and cash. Vanguard Short-Term Treasury ETF (VGSH) and Schwab US TIPS ETF (SCHP) are example holdings, with the actual amount varying with the prevailing interest rates, the real rates on TIPS, and the current rate of inflation.

Dividend and interest income yield. To estimate the income from my portfolio, I use the weighted “TTM” or “12-Month Yield” from Morningstar (checked 10/6/24), which is the sum of the trailing 12 months of interest and dividend payments divided by the last month’s ending share price (NAV) plus any capital gains distributed (usually zero for index funds) over the same period. My TTM portfolio yield is now roughly 2.53%.

In dividend investing circles, there is a metric called yield on cost, which is calculated by dividing the current dividend by the original purchase price. In other words, while my portfolio yield today is 2.53%, that is because the current market price is also a lot higher. My yield based on my portfolio value from 10 years ago (October 2015) is over 5%.

What about the 4% rule? For big-picture purposes, I support the simple 4% or 3% rule of thumb, which equates to a target of accumulating roughly 25 to 33 times your annual expenses. I would lean towards a 3% withdrawal rate if you want to retire young (closer to age 50) and a 4% withdrawal rate if retiring at a more traditional age (closer to 65). I don’t enjoy debating this number. It’s just a quick and dirty target to get you started, not a number sent down from the heavens!

During the accumulation stage, your time is better spent focusing on earning potential via better career moves, improving your skillset, networking, and/or looking for asymmetrical (unlimited upside, limited downside) entrepreneurial opportunities where you have an ownership interest.

Our dividends and interest income are not automatically reinvested. They are simply another “paycheck”. As with our other variable paychecks, we can choose to either spend it or invest it again to compound things more quickly. You could use this money to cut back working hours, pursue a different career path, start a new business, take a sabbatical, perform charity or volunteer work, and so on. You don’t have to wait until you hit a magic number. Our life path has been very different because of this philosophy. FIRE is Life!

Kraken Crypto/Brokerage: Up to 2% Deposit Bonus w/ 12-Month Hold 7 Oct 12:43 AM (15 days ago)

Kraken is offering up to a 2% deposit bonus in October for any customer that deposits $1,000+ in cash or crypto during October. The deposit bonus will vary from 1% to 2% depending on total deposits across all customers, with the strange rule that when $500 million in total aggregate deposits are made and the full 2% deposit is triggered, the entire promo ends immediately, so you need to have participated by then. The bonus will then be paid within 14 days after the promo ends, in their USDG stablecoin.

Net deposits are calculated by total cash and crypto deposited, minus withdrawals during the promotion period. Your deposits earn a 1% match rate, which can boost up to 2% based on community progress. The final rate is set based on the total community net deposit value at the end of the promo (Oct 31 or when $500M is reached).

You must keep your net deposits at Kraken through November 1st, 2026. You can trade your deposit, and market fluctuations are okay as long as you don’t withdraw any funds. Full terms here.

Kraken is best known as a crypto exchange, but as of early 2025 they now offer US stock trading under Kraken Securities through a partnership with Alpaca (press release). The terms say that you can trade your deposits, so technically I don’t see why you couldn’t move your cash to Kraken, buy a T-Bill ETF like SGOV or VBIL (current SEC yields ~4.11% and 4.12%), and basically earn up to an additional 2% APY on your cash for a year.

A 2% deposit bonus for a 12-month hold is a pretty good deal. For me, the main catch is that you have to trust the US regulatory agencies that manage SIPC insurance in case Kraken Securities fails during the next year. ETFs held in an SIPC brokerage account are definitely better than an uninsured crypto account, but I just worry it could be messy, so I’d probably size my risk (deposit amount) accordingly.

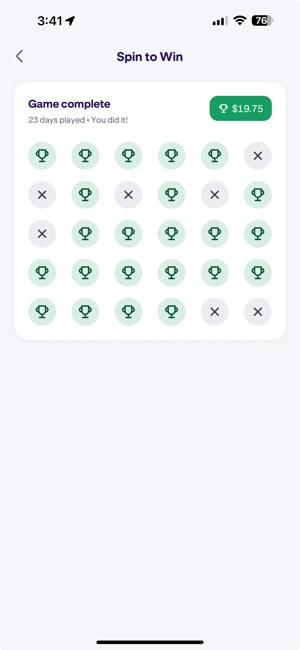

If you haven’t already, you should also grab Kraken’s $75 new crypto account bonus and 30 days of free money spins, where I earned almost $20 in random crypto like DOGE and PEPE:

MMB Portfolio Asset Allocation & Performance – 2025 Q3 Update 5 Oct 10:28 PM (16 days ago)

Here is my 2025 3rd Quarter portfolio update that includes all our combined 401k/403b/IRAs and taxable brokerage accounts but excludes our house and small side portfolio of self-directed investments. Following the concept of skin in the game, the following is not a recommendation, but a sharing of our actual, imperfect DIY portfolio.

“Never ask anyone for their opinion, forecast, or recommendation. Just ask them what they have in their portfolio.” – Nassim Taleb

How I Track My Portfolio

Here’s how I track my portfolio across multiple brokers and account types:

- The Empower Personal Dashboard real-time portfolio tracking tools (free) automatically logs into my different accounts, adds up my various balances, tracks my performance, and calculates my overall asset allocation daily. Formerly known as Personal Capital.

- Once a quarter, I also update my manual Google Spreadsheet (free to copy, instructions) because it helps me calculate how much I need in each asset class to rebalance back towards my target asset allocation. I also create a new sheet each quarter, so I have a personal archive of my portfolio dating back many years.

2025 Q3 Asset Allocation and YTD Performance

Here and at the top of this post are updated performance and asset allocation charts, per the “Holdings” and “Allocation” tabs of my Empower Personal Dashboard.

The major components of my portfolio are broad index ETFs. I do mix it up a bit around the edges, but not very much. Here is a model version of my target asset allocation with sample ETF holdings for each asset class.

- 35% US Total Market (VTI)

- 5% US Small-Cap Value (AVUV)

- 20% International Total Market (VXUS)

- 5% International Small-Cap Value (AVDV)

- 5% US Real Estate (REIT) (VNQ)

- 20% US “Regular” Treasury Bonds and/or FDIC-insured deposits (VGSH)

- 10% US Treasury Inflation-Protected Bonds (SCHP)

Big picture, it is 70% businesses and 30% very safe bonds/cash:

By paying minimal costs including management fees, transaction spreads, and tax drag, I am trying to essentially guarantee myself above-average net performance over time.

I do not spend a lot of time backtesting various model portfolios. You’ll usually find that whatever model portfolio is popular at the moment just happens to hold the asset class that has been the hottest recently.

The portfolio that you can hold onto through the tough times is the best one for you. I’ve been pretty much holding this same portfolio for 20 years. Check out these ancient posts from 2004 and 2005. Every asset class will eventually have a low period, and you must have strong faith during these periods to earn those historically high returns. You have to keep owning and buying more stocks through the stock market crashes. You have to maintain and even buy more rental properties during a housing crunch, etc. A good sign is that if prices drop, you’ll want to buy more of that asset instead of less. I don’t have strong faith in the long-term results of commodities, gold, or bitcoin – so I don’t own them.

Performance details. According to Empower, the S&P 500 keeps reaching toward all-time highs (+14% YTD) and foreign stocks continued their relative outperformance this year (+27% YTD). I wonder how long this will last?

Here’s an updated YTD Growth of $10,000 chart courtesy of Testfolio for some of the major ETFs that shows the difference in performance in the broad indexes:

My portfolio is getting a bit too stock-heavy (a good sign overall I suppose) so I am reinvesting excess income and dividends into bonds. I will stay invested for sure, but will rebalance around the edges. I’ll share about more about the income aspect in a separate post.

Mesa Homeowners Card: Mortgage Rewards + Up to 50,000 Point Bonus 2 Oct 11:30 AM (19 days ago)

Mesa is a new fintech focused on “homeowners”, currently with a credit card and mortgage lending product. Their Mesa Homeowners Visa Card (issued by Celtic Bank) currently has a 50,000 points bonus albeit with a pretty high spending requirement. The card does have a unique set of perks that could be valuable.

Bonus details:

- 50,000 bonus points after $12,000 or more on eligible purchases within the first 3 months (90 days) of Card Membership. Offer currently set to expire 10/15/25.

- To receive this offer you must apply and be approved for the Mesa Homeowners Card between 9/19/2025 – 10/15/2025 Must use code SEPT50 or CHRIS50 at card application to qualify for the offer.

- Must apply via iOS or Android app.

- Bonus points will be credited to your account within 8–12 weeks after the qualifying purchase threshold is met.

- You are not eligible to receive this welcome offer if you currently have the Mesa Homeowners Card, or if you are a previous Mesa Homeowners Card holder.

Card details:

- 1X Mesa Point per $1 on your monthly mortgage payment, up to 100,000 points annually, when you spend at least $1,000 during your statement cycle on eligible purchases with your Mesa Homeowners Card.

- 3X Mesa Points on purchases categorized under Home Decor, Home Improvement, General Contractors, Cable & Streaming Services, Home Insurance, Property Taxes, Maintenance, Telecom, Utilities and daycare. 2X Mesa Points on groceries, gas, EV charging. (Note: Target, Amazon, Walmart, Costco, Sam’s Club do NOT count as 2X.) 1X Mesa Points per $1 spent on all other eligible purchases.

- This is a confusing statement, and indeed the rewards system is a bit funky. You can earn points based on your stated monthly mortgage amount, BUT you don’t actually pay your mortgage with this credit card. However, you must charge $1,000 to the card on other things, in order to trigger the mortgage-linked rewards.

- $65 Costco Annual Credit – When you join Costco or renew your existing membership on the card.

- $120 Lowe’s Annual Credit – Maximum of $30 per quarter. Must link your myLowes Rewards account.

- $200 Thumbtack Annual Credit – Hire trusted pros for home projects

- $100 Armadillo Home Warranty Credit

- $120 Wag! Annual Credit – On-demand pet care

- $120 The Farmer’s Dog Annual Credit – Fresh, healthy meals for your pup

- No annual fee.

Fine print on the credits here.

What can Mesa points be redeemed for? Yet another currency and point system to track.

- 1.2 to 1.4 cents per points via their Travel Portal.

- 0.8 cents per point when you cash out towards your mortgage, even though you don’t actually pay your mortgage with it (it goes into your linked bank account).

- 0.8 cents per point towards gift cards.

- 0.6 cents per point as a credit card statement credit.

You can also transfer to the following at a 1:1 ratio, except for ALL which is only at a 1.5:1 ratio.

Air Canada Aeroplan

Air India Maharaja Club

Finnair Plus

Hainan Airlines Fortune Wings Club

SAS EuroBonus

Thai Airways Royal Orchid Plus

Vietnam Airlines LotusMiles

Accor Live Limitless (1.5 Mesa -> 1 ALL point)

Personally, I’d probably either go with the 0.8 cents value virtual mortgage offset, or transfer to Air Canada points.

Bottom line. This is a new fintech and so there may be some hiccups with applications, identity verification, and them changing up their features and workarounds. However, the potential first-year value is very high if you can satisfy the high initial spending hurdle. That’s up to 50,000 points upfront + 100,000 points per year on mortgage, which is worth at least $400 + $800 in cash (technically towards your mortgage).

Hilton Honors American Express Cards: Limited-Time Offer of 100,000 Points w/ No Annual Fee 2 Oct 9:48 AM (19 days ago)

Updated with new limited-time offers. Hilton Hotels and American Express have co-branded credit cards with special perks for Hilton customers. Each person can only get one welcome offer, per card in your entire lifetime, so it’s best to apply during a temporary bump-up and/or limited-time offer.

- Limited Time Offer: 100,000 Hilton Honors Bonus Points with the Hilton Honors American Express Card after you spend $2,000 in purchases on the Card within your first 6 months of Card Membership. Offer ends 1/14/2026.

- 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged on your Card directly with hotels and resorts within the Hilton portfolio.

- 5X Hilton Honors Bonus Points per dollar on purchases at US restaurants, US supermarkets, and US gas stations.

- 3X Hilton Honors Bonus Points for all other eligible purchases.

- Hilton Honors(TM) Silver Status comes with this card. Spend $20,000 on eligible purchases on this card within a calendar year and upgrade this benefit to Hilton Honors(TM) Gold Status through the end of the next calendar year.

- No foreign transaction fees.

- No annual fee.

- See Rates and Fees

- Limited Time Offer: 175,000 Hilton Honors Bonus Points after you spend $8,000 in purchases on the Hilton Honors American Express Business Card in your first 6 months of Card Membership. Offer Ends 1/14/2026.

- 12X Hilton Honors Bonus Points on eligible purchases made directly with hotels and resorts within the Hilton portfolio.

- 5X Hilton Honors Bonus Points on other purchases made using the Hilton Honors Business Card on the first $100,000 in purchases each calendar year, 3X Points thereafter.

- Up to $240 in Hilton credits annually (Up to $60 per quarter). Get up to $60 in statement credits each quarter for purchases made with this card directly with a Hilton portfolio property.

- Complimentary Hilton Honors(TM) Gold Status (free breakfast, room upgrades based on availability, 5th standard reward night free).

- Upgrade this benefit to Hilton Honors(TM) Diamond Status through the end of the calendar year if the total eligible purchases that you spend on your Card Account during a calendar year reach $40,000 or more.

- $195 annual fee.

- See Rates and Fees

What are Hilton Honor points worth? The best value is from booking free hotel nights or using their “Points & Money” option where you pay with a combination of Hilton points and cash. Hilton has some really nice properties, but the value varies from hotel to hotel. I just ran a search and for the same 60,000 Hilton points, I could book rooms that cost $320 or $532 cash. I’ve seen some valuations around 0.6 cents per point, which I think is fair on average, but I would be more conservative at 0.5 cents a point. That would make 150,000 points = $750 value and 100,000 points = $500 value towards Hilton hotel stays.

The good part of Hilton points is that they have so many different hotel brands, from business-class DoubleTree to luxury Waldorf Astoria. Hilton also lets you transfer and pool points with other with other family or household members. As long as you keep them active (once every 12 months), I do like to keep some around. These credit cards are handy for creating activity.

Free Night Award details. When it is offered (not all the time), the Free Night Award is valid for a one-night standard room at eligible Hilton properties, and also covers resort fees and taxes. There are many great and valuable options to redeem, but importantly read about the property exclusions here. Here are the full terms. To redeem the Free Night Reward, you must call 1-800-446-6677 (1-800-HHONORS). It’s quite easy and I’ve found the agents to be very helpful if you want to combine multiple certificates, combine a paid stay and a Free Night Award, etc. Free Night Rewards will expire 12 months from date of issuance.

I’ve used this Free Night Award at the Grand Wailea in Maui, and that standard room would have cost 110,000 Hilton Points otherwise. Other fancy possibilities include Conrad New York, Conrad London, Waldorf Astoria Park City, and Waldorf Astoria Beverly Hills.

Bottom line. Hilton American Express cards offer regular Hilton customers a good opportunity to earn additional points towards free Hilton hotel stays as well as additional perks like status upgrades. The best time to apply for a Hilton co-branded American Express card is during a limited-time increase to their welcome offers. This is because American Express has changed their policy to only allow each person to get a welcome offer once per card.

Also see: Top 10 Best Credit Card Bonus Offers and Top 10 Best Business Card Offers.

Hilton Honors Card from American Express: See Rates and Fees

The Hilton Honors American Express Business Card: See Rates and Fees

5% Cash Back Cards: Amazon, Drug Stores, Old Navy, Department Stores – October through December 2025 1 Oct 12:24 PM (20 days ago)

Activation reminder for 2025 4th Quarter. The credit cards below offer 5% cash back and up on specific categories that rotate each quarter. It takes a little extra attention, but it can add up to hundreds of dollars in additional rewards per year without changing your spending habits. You can also buy gift cards for other retailers at places like Grocery Stores and Home Improvement stores with 5% back now but spend the gift cards later. New cardmembers may also get an upfront sign-up bonus.

Activation reminder for 2025 4th Quarter. The credit cards below offer 5% cash back and up on specific categories that rotate each quarter. It takes a little extra attention, but it can add up to hundreds of dollars in additional rewards per year without changing your spending habits. You can also buy gift cards for other retailers at places like Grocery Stores and Home Improvement stores with 5% back now but spend the gift cards later. New cardmembers may also get an upfront sign-up bonus.

From October 1st through December 31st, 2025, you can earn 5% cash back on up to $1,500 spent in the following categories:

- Amazon.com

- Drug Stores

Enroll after logging into your online account. 5% rewards won’t apply until after you activate your rewards, so it is best to activate now before you forget. No annual fee.

Discover it $100 bonus + Double Cashback Match details. If you are a new applicant and sign up via Discover Card referral link, you will get a $50 improved $100 Cashback Bonus after your first purchase within 3 months of being account opening. On top of that, you will also get Cashback Match for an entire year – a dollar-for-dollar match of all the cash back you’ve earned at the end of your first year, automatically. During those 12 months, your 5% cash back rewards becomes 10% cash back, and your 1% cash back rewards become 2% cash back. You can verify this on the application by looking under “Terms and Conditions” or searching for “cashback match” and “statement credit offer”:

Refer a Friend: You will receive a $100 statement credit after making a purchase within three months of account opening. A Balance Transfer or Cash Advance does not qualify as a purchase. You must apply online through your friend’s digital referral link and be approved by 11:59pm ET, December 31, 2025 in order to be eligible for the $100 statement credit offer. Phone, mail-in, and other digital applications are not eligible for referral rewards. Offer may not be combined with any other introductory offer. Promotional award will be applied within 8 weeks.

Cashback Match: We’ll match all the cash back rewards you’ve earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or 365 days, whichever is longer, and add it to your rewards account within two billing periods. You’ve earned cash back rewards only when they’re processed, which may be after the transaction date. We will not match: rewards that are processed after your match period ends; statement credits; rewards transfers from Discover checking or other deposit accounts; or rewards for accounts that are closed. This promotional offer may not be available in the future and is exclusively for new cardmembers. No purchase minimums.

From October 1st through December 31st, 2025, you can earn 5% cash back (or 5X Ultimate Rewards points) on up to $1,500 spent in the following categories:

- Old Navy

- Department Stores

- Chase Travel

(The categories are also the same for the old Chase Freedom card, which is no longer available to new applicants.)

Enroll each quarter online in your Chase account or at ChaseBonus.com. As long as you activate by the 14th of the last month in each quarter, the rewards are retroactive. Technically, you earn Ultimate Rewards points which may be worth even more when converted to airline miles or hotel points instead of cash if you have a Chase Sapphire Preferred or Chase Sapphire Reserve card. You could also use the Pay Yourself Back tool to additional value. Currently, the Chase Freedom Flex card is offering new applicants a $200 bonus if you sign up and make $500 in purchases in your first three months. No annual fee.

This card offers 5% cash back on your *single* top eligible spending category up to $500 each month (which effectively adds up to $1,500 a quarter). Eligible categories include broad ones like restaurants, gas stations, grocery stores, or select travel, but you only get 5% for the top category that month and 1% on everything else. To simplify things you could, for example, elect to only use this card for 5% cash back on gas all year long (up to $500 per month).

Currently, the Citi Custom Cash card is offering new applicants a $200 bonus after you spend $1,500 on purchases in the first 6 months of account opening. You’ll actually get 20,000 ThankYou® Points, which can be redeemed for $200 cash back. No annual fee.

Blue Cash Preferred® Card from American Express

- 6% cash back at US supermarkets all year long (on up to $6,000 per year)

- 6% cash back at select US streaming subscriptions (includes Disney+, Hulu, ESPN+, Netflix, Sling, Vudu, Fubo TV, Apple Music, SiriusXM, Pandora, Spotify, YouTube TV, and more).

- $120 Disney Streaming Credit (now up to $10 per month with no minimum or bundle required). You can now earn up to $10 back per month as a statement credit when you use your enrolled Blue Cash Preferred® Card to purchase a subscription, or bundle subscription, on DisneyPlus.com, Hulu.com, or Plus.espn.com U.S. websites, now with no minimum purchase requirement. Subscription is subject to auto-renewal.

- 3% cash back at US gas stations and transit (taxis/rideshare, parking, tolls, trains, buses and more).

- $0 intro annual fee for the first year, then $95. (See Rates and Fees)

- Terms Apply.

I use this card all year long for 6% cash back on groceries up to the limit and put all my streaming services on it (including Disney+), and then in December use up the $6k annual limit on gift cards bought in the supermarket aisle. New cardholders are also eligible for a $250 welcome offer after $3,000 in purchases within the first 6 months. See details in link.

U.S. Bank Cash+ Visa Signature Card

You must choose the two 5% cash back categories every quarter, out of a preset selection of specific categories:

- Fast Food

- Cell Phone Providers

- Home Utilities

- Ground Transportation

- Select Clothing Stores

- Electronics Stores

- Car Rentals

- Gyms/Fitness Centers

- Sporting Goods Stores

- Department Stores

- Furniture Stores

- Movie Theaters

- TV, Internet, and Streaming Services

Unfortunately, you can’t pick a broad category like gas stations, restaurants, or grocery stores. Make sure to choose your categories each and every quarter, even if you want them to stay the same. If you do not choose your categories, all purchases revert to only earning 1% cash back for that quarter. No annual fee. Currently, new applicants are offered a $200 bonus after you spend $1,000 in eligible purchases within the first 120 days of account opening.

Earn 5% back at Amazon.com and Whole Foods all year long. Up to 10% cash back on select items during special promos. Prime membership required. New cardholder bonus varies by account. No annual fee.

Citi Dividend Card. This card has not been available to new applicants for years now, but if you still have the grandfathered card you can view and activate your quarterly 5% category here. Limit of $300 cash back for the calendar year.

Rates and Fees for Blue Cash Preferred® Card from American Express :Rates and Fees for Blue Cash Preferred® Card from American Express

Bank of America Credit Cards – 2% More Rewards Day on Thursday 11/6/2025 28 Sep 10:24 PM (23 days ago)

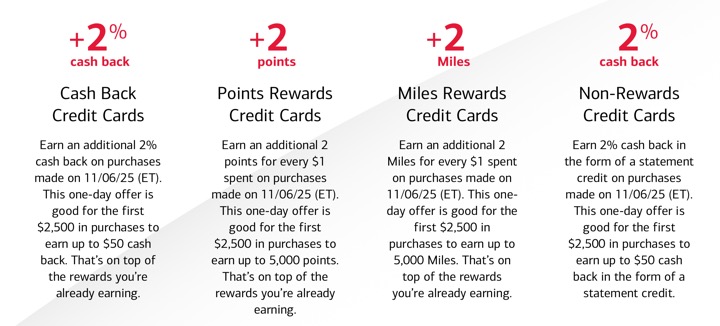

Back for 2025. Bank of America has a one-day credit card promotion called “More Rewards Day” on Thursday, 11/6/25. Depending on your BofA credit card type (both consumer and business cards are all eligible), you can earn an additional 2% cash back or 2 points or miles/$1 spent on up to $2,500 in purchases made on 11/6/25 only (Eastern time zone!), up to a $50/5,000 point cap per unique credit card account. That’s on on top of the rewards you’re already earning. No enrollment required.

Eligible cards include:

Customized Cash Rewards

Unlimited Cash Rewards

Travel Rewards

Premium Rewards®

Premium Rewards® Elite

BankAmericard® Power Rewards®

BankAmericard Rewards®

MERRILL+®

MERRILL+® Elite

Atmos Rewards Ascent

Rewards Ascent

Atmos Rewards Summit

Rewards Summit

Royal Caribbean®

Celebrity Cruises®

Norwegian Cruise Line

Beaches

Sandals

Free Spirit®

Allegiant

Air France KLM

BankAmericard®

You can get up to a $50 bonus on each of your unique BofA credit cards. Note that it expires 11:59pm in the Eastern time zone. It appears that somehow they can track the “transaction date” separately from when it posts to your statement. Note that some retail websites don’t actually charge you until a physical item ships.

Only Purchases that post to your account and appear on your statement with a transaction date of 11/06/2025 will qualify. Merchants may impact when a transaction will appear on your statement, particularly if they delay processing of the purchase. Transactions with delayed processing of 90 days or more will not be eligible to be included in the promotional offer.

Some possibilities beyond timing the normal bonus categories on your unique cards:

- Pay estimated income taxes at PayUSATax.com for currently a 1.75% fee.

- Pay your insurance premiums upfront. My State Farm grouped monthly bill can also be timed using manual payment.

- Pay your utilities, property taxes, phone bills, and other monthly bills upfront. Sometimes it just costs a one-time flat fee to pay by credit card, which can be worth if you are charging $1,000+.

- Make your annual charitable contributions for this year on this date.